- Blog

- |Managing Payroll

- >Cashflow

- >Cash management

The importance of good cash management

The chances are we’ve all been told at one stage or another to better manage our cash. While many of us may float from pay cheque to pay cheque, businesses have to be a little more careful about the way they handle their money.

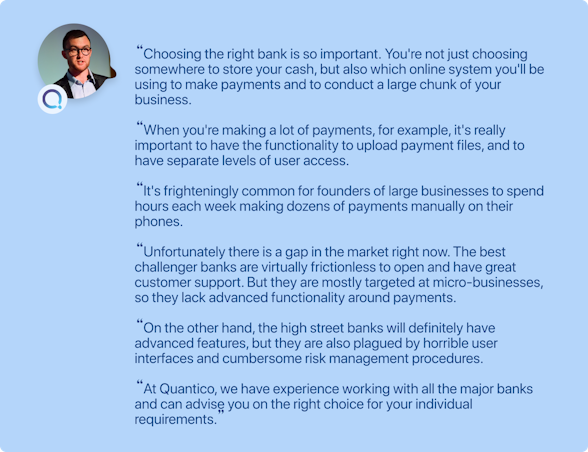

We sat down with Dan Hully, co-founder and CEO of Quantico, a company that specialises in providing in-house finance teams to rapidly scaling businesses, to discuss cash management for SMEs and startups.

Why is cash management so important in business?

The term “cash management” is a broad term that refers to the disbursement, collection and concentration of cash.

A finance manager’s job is to ensure that appropriate levels of capital are readily available to the company for short-term investment strategies, and avoid the risk of insolvency and bankruptcy.

For startups and SMEs, cash management takes on even great significance. Cash flow can be difficult for some companies, even when there is a strong and reliable customer base. Without the cash foundations of more established organisations, startups risk running aground quickly if cash isn’t managed correctly.

The financial consequences of ineffective cash flow management can be serious and could lead to companies not having enough in the bank to deal with unanticipated events.

Cash management in a crisis

The coronavirus crisis laid bare in the harshest of ways the importance of effective cash management. Businesses whose finances were relatively secure were suddenly faced with a situation where they were looking to source funds from elsewhere.

Unfortunately, and as many have discovered, it can be complicated to borrow money when there isn’t much evidence of any pre-existing funds.

But why is it that so many businesses have so little left in reserve?

The simple answer is that lots of companies rely on a steady supply of work to ensure that there is a regular flow of cash into their business.

However, with lockdown measures essentially shelving projects overnight, many companies found themselves in a situation where cash immediately stopped coming in.

While even large companies with significant reserves have been, and continue to be, affected—the pandemic highlighted just how vulnerable many small businesses are.

How can companies improve their cash management?

Everyone is striving to meet daily cash requirements at the lowest possible cost and, in light of recent events, many businesses are beginning to realise the importance of consolidating their finances while ensuring effective cash management procedures are in place.

But how can companies improve their cash management?

1. React quickly on past due invoices

Generally, the longer you leave something, the harder it gets.

This is certainly true when it comes to chasing invoices. However, one way of negating overdue payments is by ensuring that a company’s billing system produces accurate and reliable invoices.

An invoice that clearly displays the amount due, the due date, to whom the payment is due and the payment methods accepted, can help ensure that money is received on time and in the right way.

Clients can be a nightmare, and the unscrupulous ones will always look for any excuse to avoid making payments straight away.

As a result, businesses must be brave enough to chase their clients on outstanding payments. To do this, there should be transparent processes designed to ensure that collecting outstanding payments doesn’t become a long and arduous task.

2. Set internal controls

Cash is the asset that has the greatest chance of “going missing”. This means that companies need to make sure that there are strong internal controls built around the cash process.

To minimise problems and prevent errors, finance managers should look to initiate separation of duties and limit access to internal financial systems.

In smaller businesses, this may be easier said than done. However, no business should allow one single person to have control over the entire cash process.

3. Stay on top of trends and build relationships

There are various tools out there that can help companies manage their cash; however, one of the best, but most underutilised sources of help can be a company’s bank.

Many banks provide cash management tools that can help companies to aggregate all of their accounts and provide a versatile and comprehensive view of all daily operations.

While it may seem obvious, banks are best placed to offer financial services and advice to businesses that are looking to improve their cash flow. Consequently, any finance manager worth their salt should look to build a positive relationship with their bank.

Not only is it good practice to maintain the image of the company, but it can also look to help ensure better funding opportunities in the future.

A UK 4-Day Working Week - Thoughts On Labour’s Plan

Running payroll - A Guide For New Businesses

The Alabaster Ruling & Maternity Pay - A Guide For Employers

The End Of Zero Hours Contracts? Implications For Businesses

What is the HM Revenue and Customs Starter Checklist